Securities star news, as of the close of December 18, 2023, Global printing (002799) closed at 12.3 yuan, up 5.67%, turnover rate of 14.47%, turnover of 463,000 lots, turnover of 577 million yuan.

In terms of capital flow data on December 18, the net inflow of main funds was 59.3374 million yuan, accounting for 10.29% of the total turnover, the net outflow of hot capital funds was 40.218,900 yuan, accounting for 6.97% of the total turnover, and the net outflow of retail funds was 19.118,600 yuan, accounting for 3.32% of the total turnover.

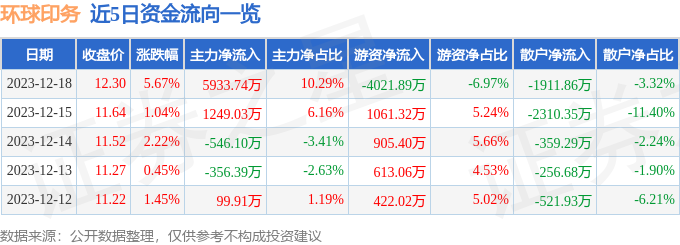

The flow of funds in the past 5 days can be seen in the following table:

The main indicators and industry rankings of the stock are as follows:

Global printing in 2023 three quarterly report shows that the company's main income of 1.962 billion yuan, down 18.31%; Net profit of 43.498 million yuan, down 47.59%; Non-net profit of 41.509,900 yuan, down 44.34% year-on-year; In the third quarter of 2023, the company's main income in a single quarter was 634 million yuan, down 40.44% year-on-year; Net profit attributable to mother in the single quarter was 14.3393 million yuan, down 162.94% year-on-year; The non-net profit deducted in the single quarter was 14.6684 million yuan, down 175.65% year-on-year; Debt ratio 28.82%, investment income 5.176,700 yuan, financial expenses 800.78 million yuan, gross profit rate 11.31%. Global Printing (002799) Main business: design, production and sales of medical cartons and other paper packaging products, design, production and agency of mobile network advertising, supply chain management of printing and packaging industry.

Capital flow noun explanation: refers to the reverse push of capital flow through price changes. When the stock price is rising, the turnover generated by the active purchase is the force driving the stock price up, and this part is defined as the capital inflow; when the stock price is falling, the turnover generated by the active sell order is the force driving the stock price down, and this part is defined as the capital outflow. The difference between the two on that day is the net force left after the two forces equal to push the stock price up. The main capital flow, hot capital flow and retail capital flow are calculated through the transaction amount of each transaction.

Note: The main fund is a large single transaction, the hot capital is a large single transaction, and the retail investor is a small and medium-sized single transaction